Your Choice for MONETARY NEEDS

Empowering the common man by offering accessible business credits and tailored support services, we aim to fuel entrepreneurial growth and financial independence. Through flexible credit programs, low-interest rates, and expert guidance, we bridge the gap between ambition and achievement for small business owners. Our comprehensive support structure includes business mentorship, financial literacy programs, and streamlined processes to ensure every entrepreneur, regardless of background or resources, has the tools to succeed. By fostering innovation and creating sustainable opportunities, we are dedicated to building a future where everyone can thrive economically. Our commitment extends beyond just providing financial assistance - we believe in building lasting relationships with our clients through personalized consultation and ongoing support throughout their business journey.

What you need to know about CN Credit Support

CN Credit Support Limited was duly incorporated under the Companies and Allied Matters of Nigeria act 2020 as a private company limited by shares, on the 30th of May, 2024 with Registration No. 7535684. CN Credit Support Limited is an independent but an associate company of CN Tickets And Travels Limited, licensed on the 9th day of July, 2024 by Lagos State Ministry of Home Affairs to carry on the business of a Money Lender under the style and title of CN Tickets And Travels Limited, at No. 17 Adewole Street, By Olugbede Market, Egbeda, Alimosho, Lagos.

CN Credit Support Limited is committed to its passion of assisting to improve the business opportunities of Entrepreneurs and SMEs by providing them with easy access to affordable loans, and as well improve the general financial status of its customers with its Deposits Accounts.

Vision

Our vision is to strive hard to be one of the leading providers of financial services in the market and contribute to the development of the Nigerian Financial Sector.

Mission

To deliver exceptional and efficient services to our clients, whilst ensuring that our Shareholders and Employees derive maximum value from the growth of the Company.

Values

- Personal/Micro Loans

- Educational Loans

- Business Support

- Asset Financing

- Daily Contributions

- Monthly Contributions

- SMEs Loans

- Deposits

Our Services

Our services span diverse sectors and industries, empowering financial growth

and stability for businesses and individuals alike.

Personal/Micro Loans

Personal loans are small, unsecured loans given to individuals to meet their personal needs. These loans can be used for various purposes such as home improvements, medical expenses, or emergency needs. Micro loans, on the other hand, are specifically small loans aimed at individuals or small businesses who may not have access to traditional banking services. Micro loans are particularly useful in developing economies, helping entrepreneurs or small businesses with working capital.

SMEs Loans

Small and Medium Enterprises (SMEs) Loans are designed to provide financing to small and medium-sized businesses. These loans support the growth and expansion of SMEs by offering capital for operational expenses, equipment purchases, or business development. SME loans are crucial for fostering entrepreneurship and supporting the economic growth of a region, as they offer smaller businesses the ability to compete and scale their operations.

Educational Loans

Educational loans provide financial assistance to students or their families to cover tuition fees, accommodation, books, and other related educational expenses. These loans can be offered at favorable interest rates, often with repayment terms that begin after the student graduates. They are critical in helping individuals access higher education and professional development, which they might otherwise be unable to afford upfront.

Business Support

Business support services include loans or financial products specifically tailored to meet the needs of businesses. This could involve working capital financing, lines of credit, or loan facilities to help businesses manage cash flow, expand operations, or invest in new projects. Business support typically also involves advisory services to help businesses navigate financial decisions and improve operational efficiency.

Asset Financing

Asset financing is a type of lending in which businesses or individuals secure loans by using their assets (such as machinery, vehicles, or equipment) as collateral. Asset financing allows borrowers to purchase or lease large assets without paying the full cost upfront. Instead, they can spread out the payments over time. This is often used for acquiring equipment or real estate necessary for business growth.

Daily Contributions

Daily contributions, also known as "ajo" or "esusu" in some parts of Africa, are a traditional saving scheme where individuals contribute a fixed amount daily into a collective pool. These contributions are then distributed to a participant at regular intervals, allowing individuals to save consistently or access pooled funds for business or personal use. Financial institutions sometimes formalize this process by offering daily contribution accounts to help customers save regularly.

Monthly Contributions

Similar to daily contributions, monthly contributions involve participants contributing a set amount of money on a monthly basis. These savings or funds are then distributed or made accessible to members based on pre-agreed terms. This is often used as a savings plan or to create a pool of funds that members can access for specific needs, such as emergencies, education, or business growth.

Deposits

Deposits refer to the money customers place in a financial institution such as a bank or credit union for safekeeping. These deposits can be held in different types of accounts, including savings accounts, fixed deposits, or checking accounts. In return, financial institutions may offer interest on these deposits, and customers can access their money as needed, depending on the type of deposit account.

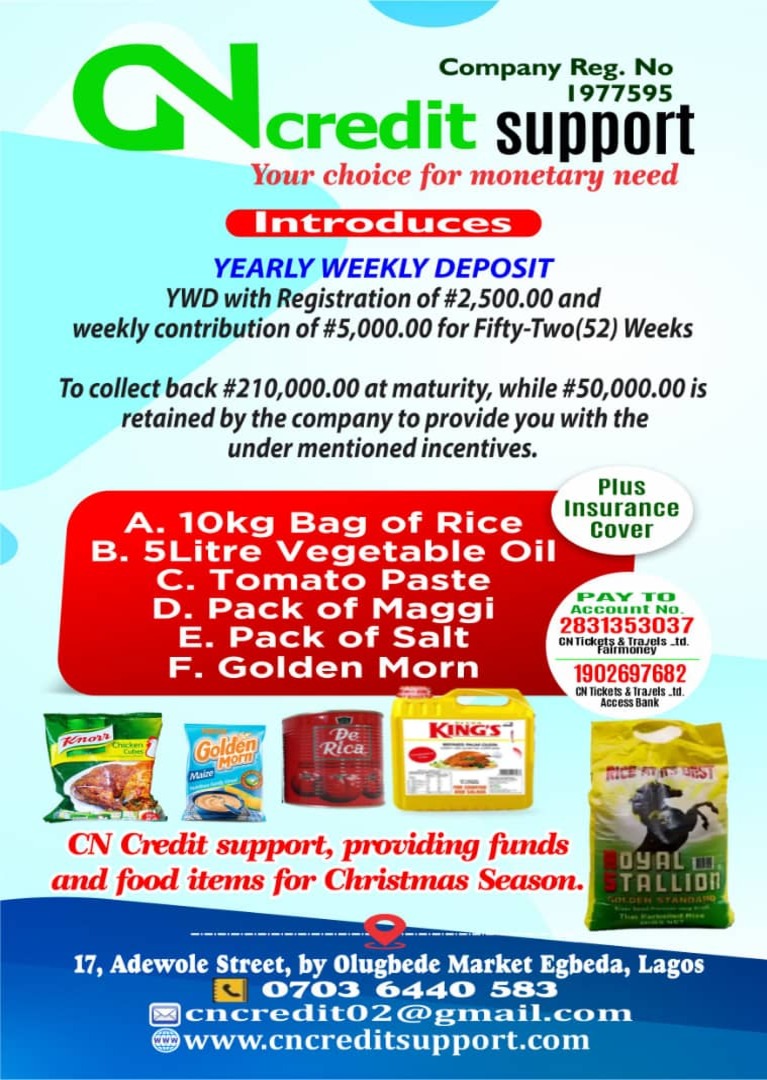

Our Special Packages

We have introduced these 3 special packages to assist our esteemed customers cultivate the habit of saving and at the end of each tenure, there are gifts to be won too. Our carefully designed savings programs not only help build your financial discipline but also reward your commitment with exclusive benefits and incentives. Whether you're saving for short-term goals or long-term security, our flexible packages accommodate various financial capabilities and time horizons. Through our rewards system, we celebrate your savings milestones with valuable gifts, creating an encouraging environment that makes the journey toward financial freedom both rewarding and enjoyable.

Our Story Through Images

Our services span diverse sectors and industries, empowering financial growth and stability for businesses and individuals alike.

Contact Us today

CN Credit Support Limited is reachable through all the platforms listed below

CN Credit Support Limited

We are located at:

17 Adewole Street, By Olugbede Market, Egbeda, Alimosho, Lagos.

Phone No.

Email address